However, when synthesizing this data, it becomes apparent there are some clear trends emerging. Canadians want to make and keep travel plans. The pandemic has taught everyone to see the value in the getaway. Consumers also desire to shop intentionally and appreciate options in purchasing channels, opting for both brick and mortar and online storefronts. However, many are still persuaded by effective media campaigns.

The pandemic has taught many that life experiences matter most. As a result, many are holding on firmly to their travel plans. While looming economic distress may make consumers careful purchasers, there is still growth in retail categories related to travel. Pivoting product positioning into these more experiential applications capitalizes on this desire to get away.

Pinched pockets are pushing consumers to prioritize spending. The result is a more intentional consumer journey. From looking up deals and availability on their phone to following through on their planned purchases in store, the new generation of the omni-shopper is informed and willing to spend on what matters most.

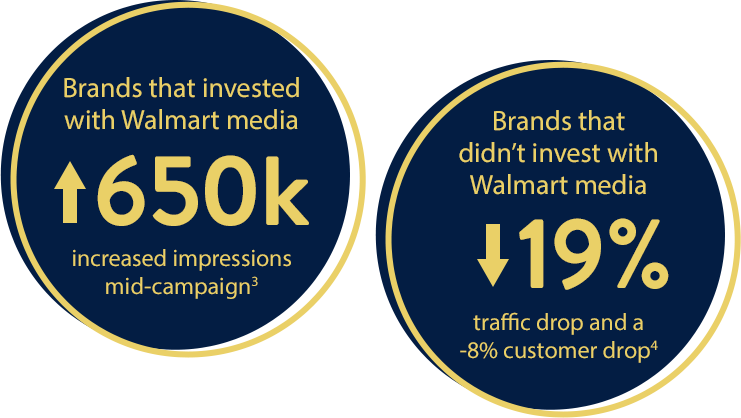

As marketing budgets are tightening, competition for consumer visibility is on the rise. Conscious investing in omni-shopping advertising can help businesses stay essential. Despite market volatility, it’s clear that when consumers are immersed in targeted media, they are more committed to the brands they love.

Interested in the full Q2 Insights Report? Please contact your Walmart Connect representative or request a copy by email.